In a classic bit of 'maskirova' (deception) JP Morgan has been admitting a $2 billion trading 'loss' publicly.

- Gee, so honest and forthcoming of JPM's Jamie Dimon to do this, eh? Way to "man up!"

And $2 billion is 'chump change' on Wall Street and in Washington these days, right?

- No sweat. No problem. Nothing to see here. Now move along and just ignore the chalk outline on the sidewalk.

How about if a bigger 'loss' is hiding in plain sight, and this is mere sleight of hand? A distraction?

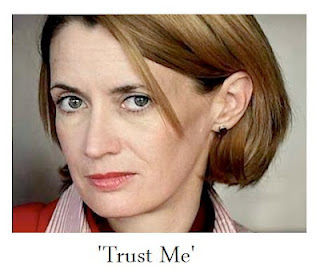

- Would America's "best run bank"* lie? Say it ain't so! Not Jamie! Not Blythe!

Let's peel this onion 1-2-3:

1. Today's "The Independent" is noting that JPM's 'losses' could have already mushroomed to $7 billion.

2. JPM abruptly stopped its share repurchases today.

3. Page 73 of the recent NY Fed stress test of JPM [attached] implies a statutory loss threshhold of $31.5 billion.

- The highlighted section is the gating condition for how much pain the Fed will permit JPM to have before share repurchases are not allowed because its capital structure is endangered/impaired.

Conclusion? JPM's 'real' potential losses exceed the $31.5 billion loss-limit?

- Nice. Well done lads! Publicly admitting a $2 billion loss which is actually somewhere North of $32 billion in all probability?

Crying from that onion yet?

- What you don't know CAN hurt you....especially if you're a Muppet investing in JPM!

*Barack Obama speaking to the White House stenography corps (aka the MSM) from the shallow end of the gene pool about JPM.

Tuesday, 22 May 2012

Hiding in plain sight 1-2-3?...............from Rico

From

Theo Spark

at

18:40

![]()

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment